CANCELLATION OF REGISTRATION IN GST

The registration permit under GST can be cancelled for identify reasons. The cancellation can either be take action on by the department on their own motion or the registered person can apply for cancellation of their registration. In case of death of registered person, the legal heirs can apply for cancellation the registration on the behalf of registered person. In case the registration has been cancelled by the department there is person has to a provision for abrogation of the cancellation. On abandonment of the registration the file a return which is called the final return.

The registration can be repealed for the following reasons:

-

A person registered under any of the having any laws, but who is not liable to be registered under the GST Act;

-

The business has been abandoned, transferred fully for any reason including death of the proprietor, amalgamated with other legal entity, demerged or otherwise disposed of;

-

There is any change in the regulations of the business;

-

The taxable person (other than the person who has willingly taken registration under sub-section (3) of section 25 of the CGST Act, 2017) is no longer liable to be registered;

-

A registered person has contravened such funds of the Act or the rules made there under;

-

A person paying tax under Composition levy has not enhances returns for three consecutive tax periods;

-

Any registered person, other than a person paying tax under Composition levy has not enhances returns for a continuous period of six months;

-

Any person who has taken willingly registration under sub-section (3) of section 25 has not commenced business within six months from the date of registration;

-

Registration has been achieved by means of fraud, willful misstatement or suppression of facts.

-

A person already registered under any of the existing laws (Central excise, Service tax, VAT etc.), but who now is not liable to be registered under the GST Act has to put forward an application electronically by 31ST December 2020, in FORM GST REG-29 at the common portal for the cancellation of registration granted to him. The Superintendent of Central Tax.

-

The cancellation of registration under the State Goods and Services Tax Act or the Union country Goods and Services Tax Act, as the case may be, shall be deemed to be a cancellation of registration under Central Goods and Services Tax Act.

-

in the event, the Superintendent of Central Tax has causes to believe that the registration of a person is liable to be cancelled, a notice to such person in FORM GST REG-17, requiring him to show cause, within a period of seven working days from the date of the service of such notice, as to why his registration shall not be cancelled; will be issued.

-

The reply to the show cause notice issued has to be give by the registered person in FORM REG– 18 within a period of seven working days.

-

In case the reply to the show cause notice is found to be acceptable, the Superintendent of Central Tax will drop the proceedings and pass an order in FORM GST REG –20.

-

However, when the person who has conformed an application for cancellation of his registration is no longer liable to be registered or his registration is liable to be cancelled, the Superintendent of Central Tax will issue an order in FORM GST REG-19, within a period of thirty days from the date of application or, as the case may be, the date of the reply to the show cause issued, cancel the registration, with effect from a date to be determined by him and notify the taxable person, directing him to pay arrears of any tax, interest or penalty.

-

The registered person whose registration is repealed shall pay an amount, by way of debit in the electronic credit ledger or electronic cash ledger, equivalent to the credit of input tax in respect of inputs held in stock and inputs contained in semi-finished or finished goods held in stock or capital goods or plant and machinery on the day immediately preceding the date of such cancellation or the output tax payable on such goods, whichever is higher.

-

In case of capital goods or plant and machinery, the taxable person shall pay an amount equal to the input tax credit taken on the said capital goods or plant and machinery, decreased by such percentage points as may be prescribed or the tax on the transaction value of such capital goods or plant and machinery under section 15, whichever is higher.

-

The cancellation of registration shall not affect the liability of the person to pay tax and other dues for any period prior to the date of repealed whether or not such tax and other dues are determined before or after the date of cancellation.

When the registration of a registered person other than an Input Service Distributor or a non-resident taxable person or a person paying tax under the composition scheme or TDS/TCS; has been cancelled, the person has to file a final return within three months of the date of cancellation or date of order of cancellation, whichever is later, electronically in FORM GSTR-10 through the common portal either directly or through a Facilitation Centre notified by the Commissioner.

-

When the registration has been repealed by the Proper Officer (Superintendent of Central Tax) on his own moving and not on the basis of an application ,then the registered person, whose registration has been cancelled, can submit an application for revocation of cancellation of registration, in FORM GST REG-21, to the Proper Officer (Assistant or Deputy Commissioners of Central Tax), within a period of thirty days from the date of the service of the order of cancellation of registration at the common portal, either directly or through a Facilitation Centre notified by the Commissioner.

-

However, if the registration has been cancelled for failure to furnish returns, application for repudiation shall be filed, only after such returns are furnished and any amount due as tax, in terms of such returns, has been paid along with any amount payable to - wards interest, penalty and late fee in respect of the said returns.

-

On examination of the application if the Proper Officer (Assistant or Deputy Commissioners of Central Tax) is satisfied, for motive to be recorded in writing, that there are sufficient grounds for repudiation of cancellation of registration, then he shall revoke the cancellation of registration by an order in FORM GST REG-22 within a period of thirty days from the date of the receipt of the application and communicate the same to the applicant.

-

However, if on examination of the application for revocation, if the Proper Officer (Assistant or Deputy Commissioners of Central Tax) is not satisfied then he will issue a notice in FORM GST REG–23 requiring the applicant to show cause as to why the application submitted for revocation should not be rejected and the applicant has to furnish the reply within a period of seven working days from the date of the service of the notice in FORM GST REG-24.

-

Upon receipt of the information or clarification in FORM GST REG-24, the Proper Officer (Assistant or Deputy Commissioners of Central Tax) shall dispose of the application within a period of thirty days from the date of the receipt of such information or clarification from the applicant. In case the information or clarification provided is satisfactory, the Proper Officer (Assistant or Deputy Commissioners of Central Tax) shall dispose the application as per Paragraph (iii) above. In case it is not satisfactory the applicant will be mandatorily given an opportunity of being heard, after which the Proper Officer (Assistant or Deputy Commissioners of Central Tax) after recording the reasons in writing may by an order in FORM GST REG- 05, reject the application for revocation of cancellation of registration and communicate the same to the applicant.

-

The revocation of cancellation of registration under the State Goods and Services Tax Act or the Union Territory Goods and Services Tax Act, as the case may be, shall be deemed to be a revocation of cancellation of registration under Central Goods and Services Tax Act

To file for cancellation of GST registration, please perform the following steps:

-

Visit the URL: https://www.gst.gov.in.

-

Login to the GST Portal with your user-ID and password.

-

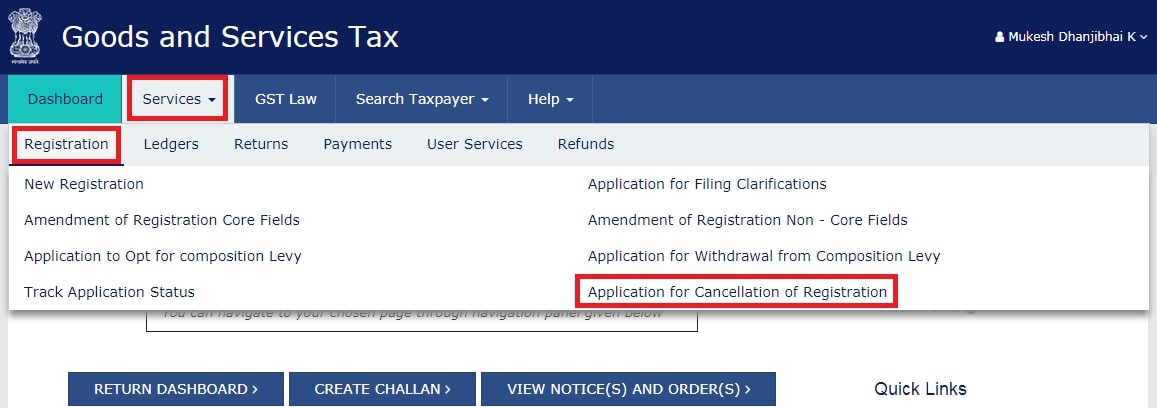

Navigate to the Services > Registration > Application for Cancellation of Registration option.

-

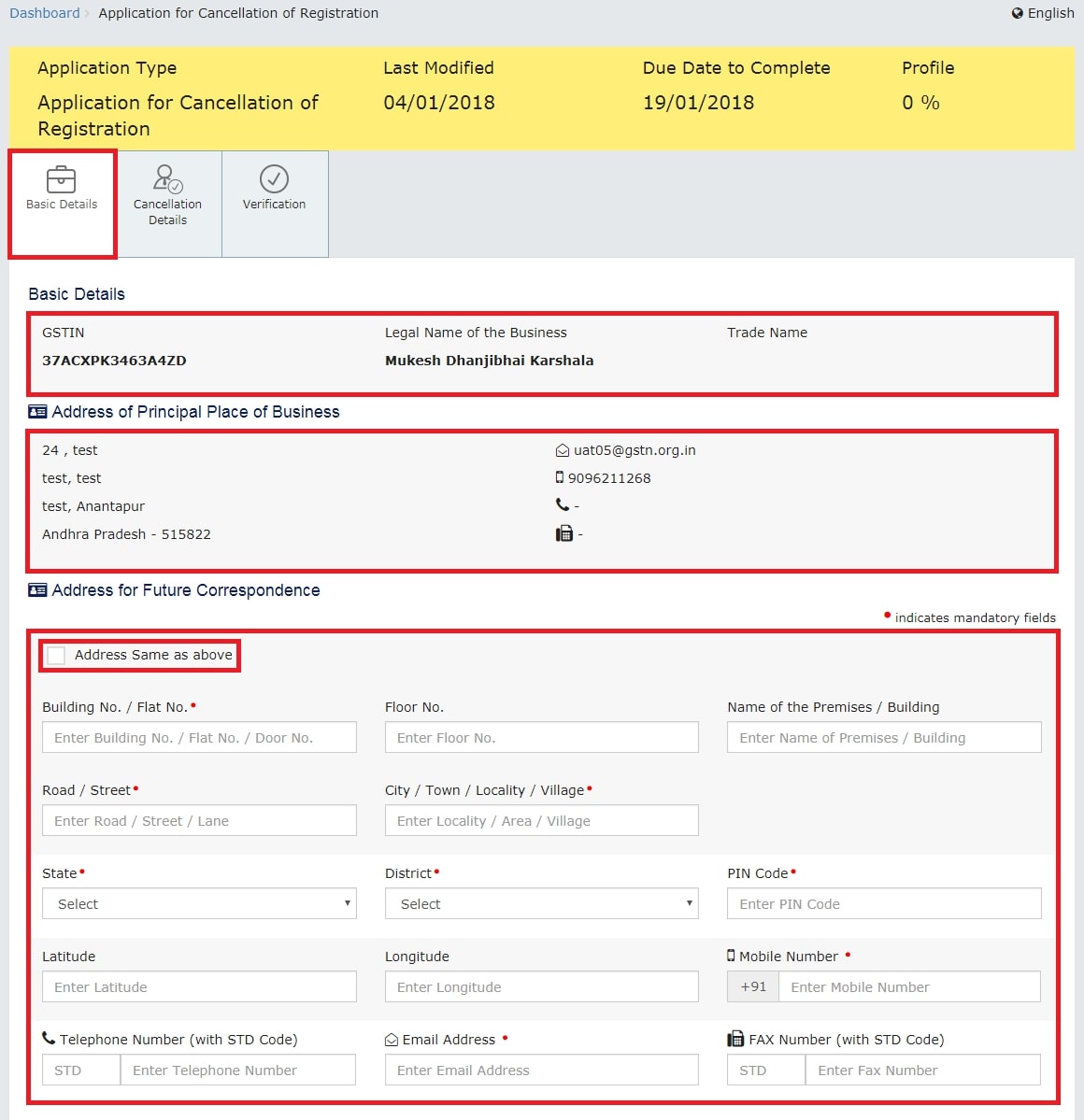

The form - Application for Cancellation of Registration contains three tabs. Ensure that the Basic Details tab is selected by default.

Note: The first tab contains pre-filled information in sections of Basic Details and Address of Principal Place of Business. -

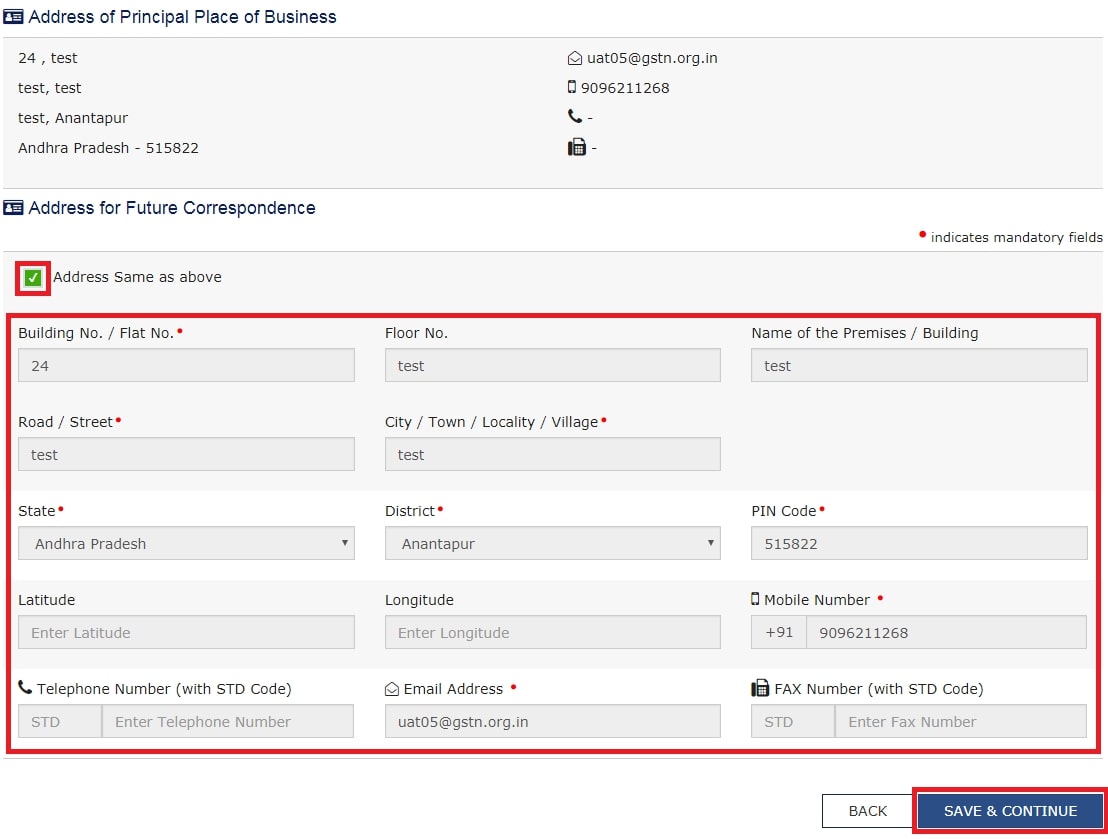

Either fills your Address for Future Correspondence manually, or check the option of Address same as above to copy the same address as in the Address of Principal Place of Business field.

-

Click the SAVE & CONTINUE button.

Notes:-

The tab Basic Details will change to blue color and a tick mark will appear on it indicating that all the mandatory fields under this tab have been duly filled-in.

-

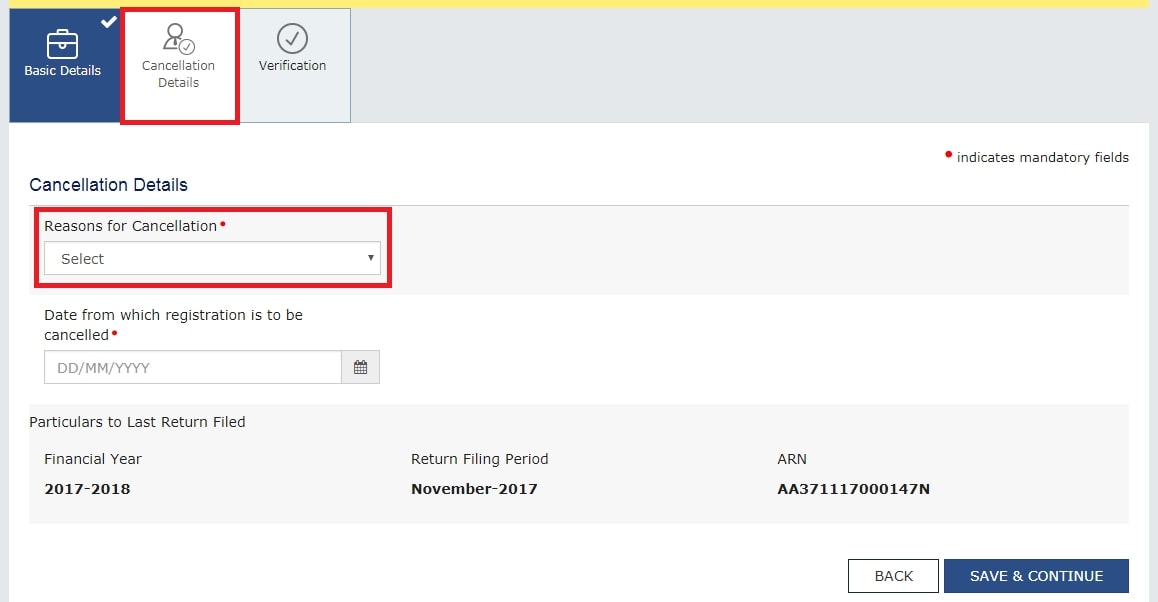

The next tab Cancellation Details will get active, requiring you to make suitable selections and provide relevant information in corresponding fields.

-

-

Select a suitable reason from the Reason for Cancellation drop-down list.

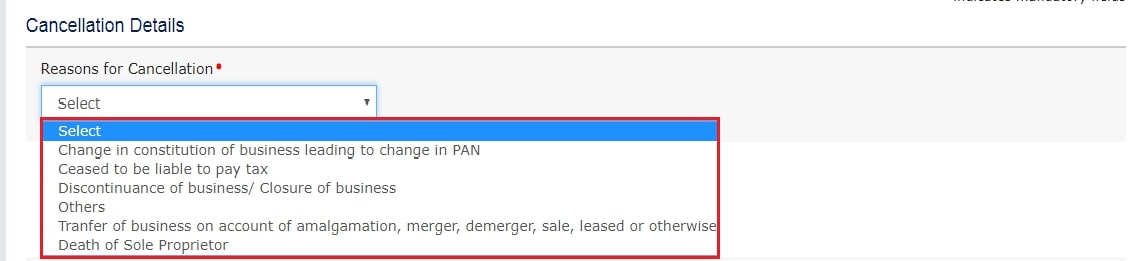

Notes: The following five reasons are available for selection:-

Change in constitution of business leading to change in PAN

-

Ceased to be liable to pay tax

-

Discontinuance of business / Closure of business

-

Others

-

Transfer of business on account of amalgamation, merger, demerger, sale, leased or otherwise

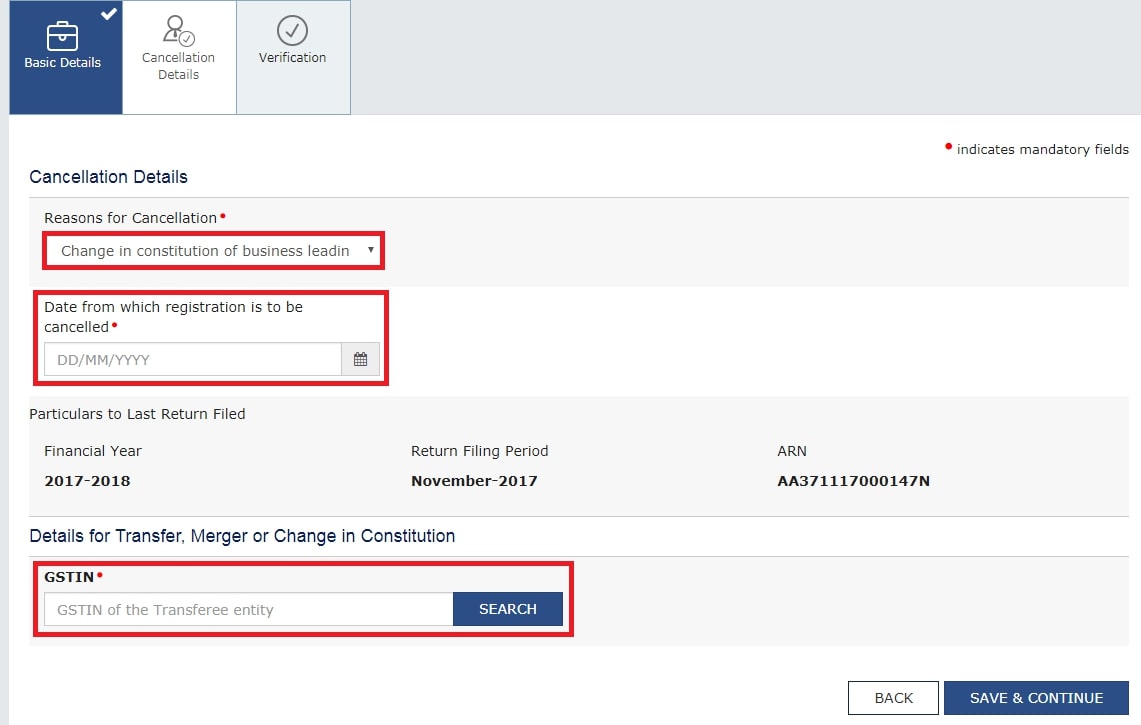

Change in constitution of business leading to change in PAN:-

Enter the date from which registration is to be cancelled.

-

Provide the GSTIN of the transferee entity under the Details for Transfer, Merger or Change in Constitution section. System will validate the same, and based upon it’s Legal Name of Business, will auto-populate the Trade Name.

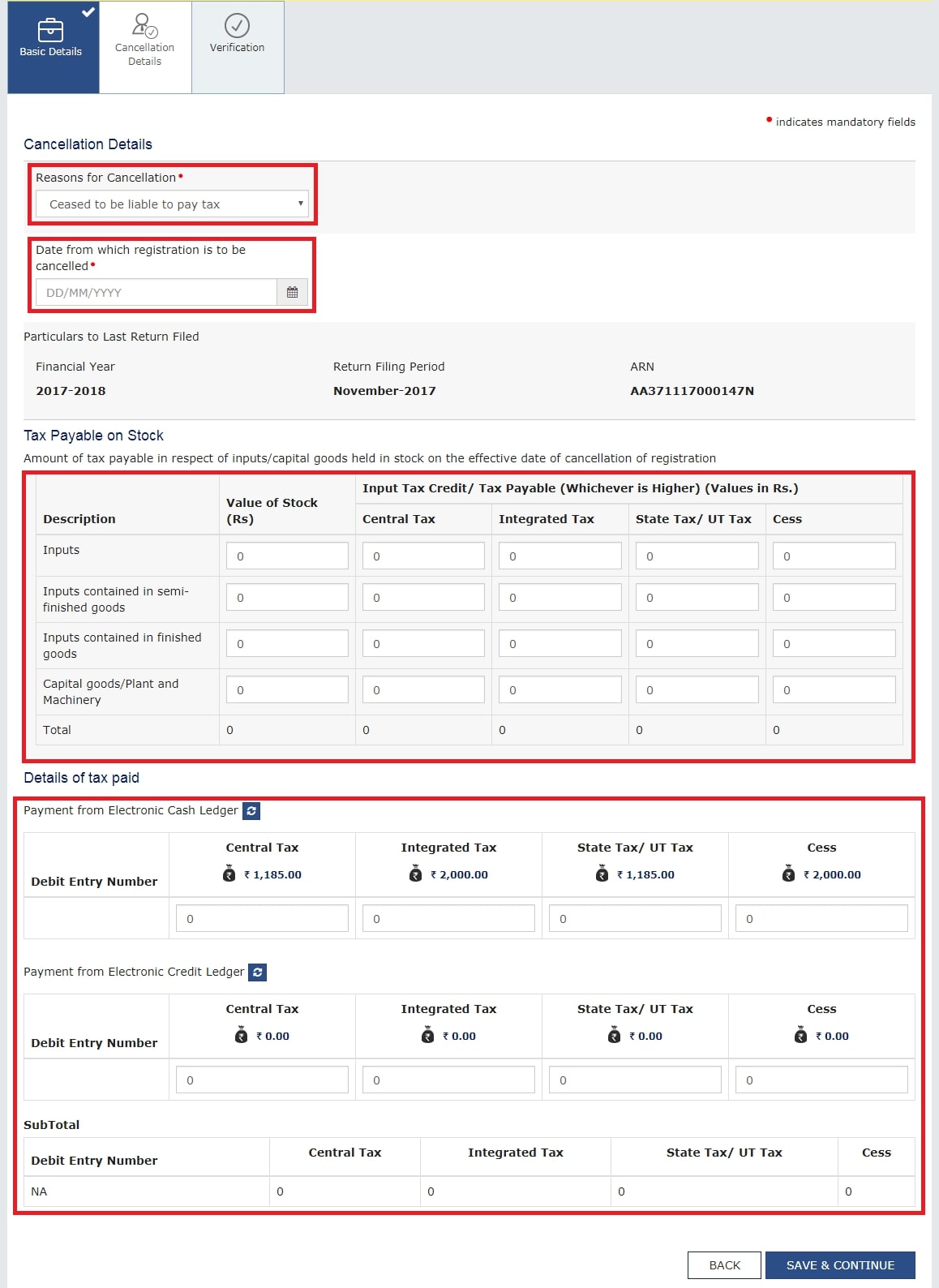

Ceased to be liable to pay tax:-

Enter the date from which registration is to be cancelled.

-

Enter the value of stock and the corresponding tax liability on the stock.

-

Basis the entered stock details, enter the value to offset the liability (tax payable) that you wish to offset from either the Electronic Cash Ledger, or the Electronic Credit Ledger, or both.

-

On submitting the form, the amount will be deducted from the respective Electronic Cash Ledger, or the Electronic Credit Ledger, or both, and debit entries will be made.

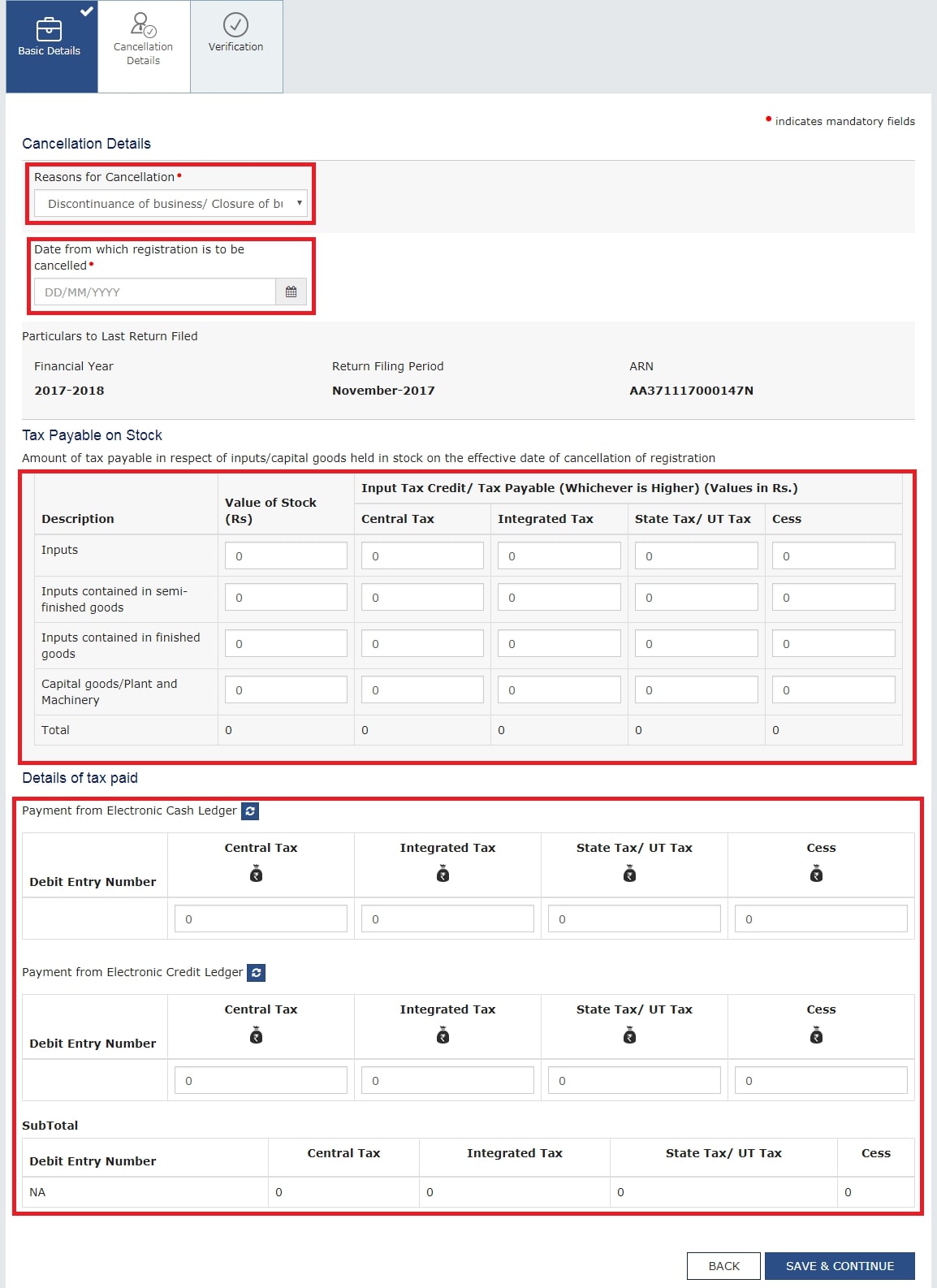

Discontinuance of business / Closure of business:-

Enter the date from which registration is to be cancelled.

-

Enter the value of stock and the corresponding tax liability on the stock.

-

Basis the entered stock details, enter the value to offset the liability (tax payable) that you wish to offset from either the Electronic Cash Ledger, or the Electronic Credit Ledger, or both.

-

On submitting the form, the amount will be deducted from the respective Electronic Cash Ledger, or the Electronic Credit Ledger, or both, and debit entries will be made.

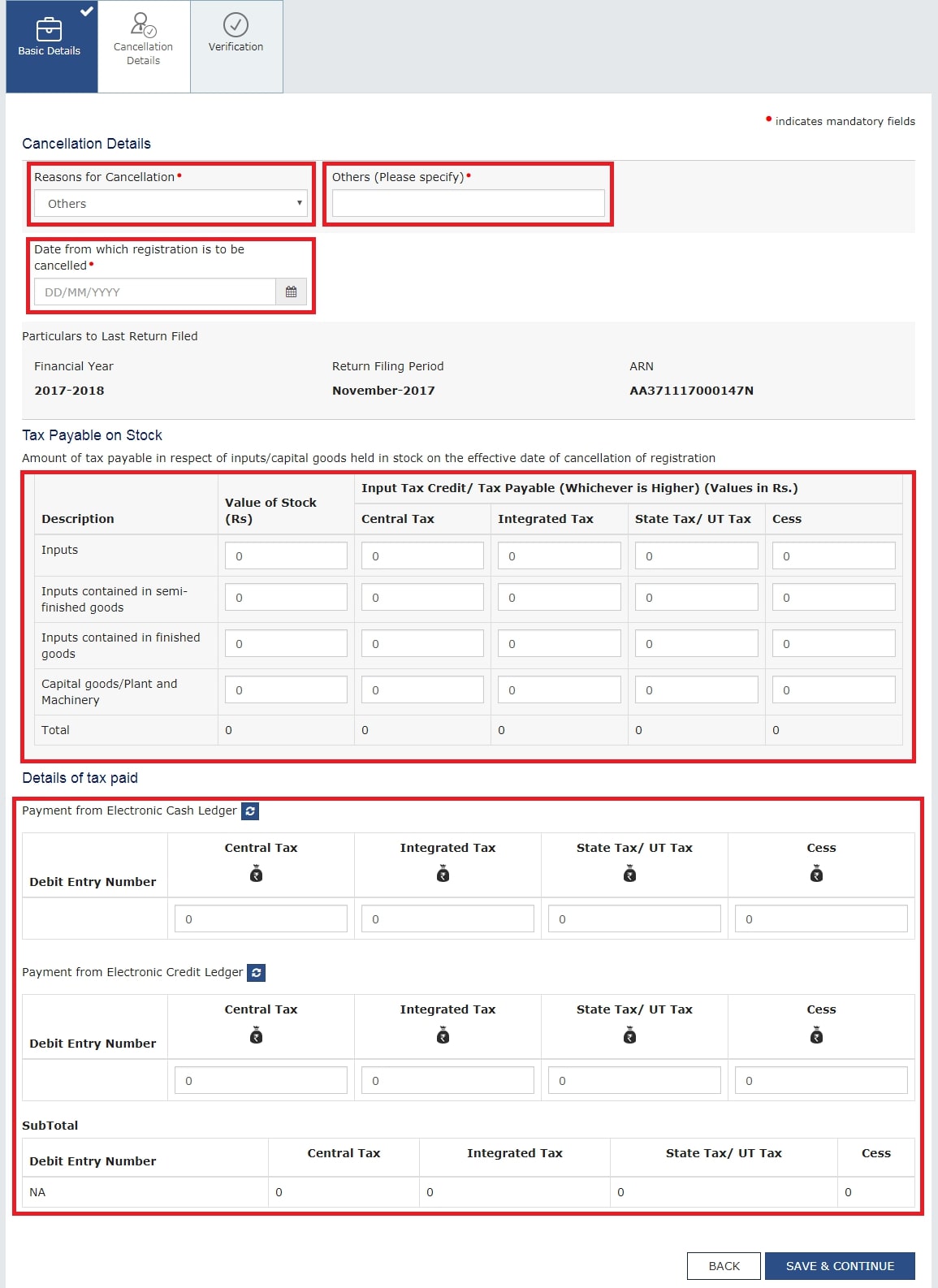

Others:-

Specify the reason for cancellation.

-

Enter the value of stock and the corresponding tax liability on the stock.

-

Basis the entered stock details, enter the value to offset the liability (tax payable) that you wish to offset from either the Electronic Cash Ledger, or the Electronic Credit Ledger, or both.

-

On submitting the form, the amount will be deducted from the respective Electronic Cash Ledger, or the Electronic Credit Ledger, or both, and debit entries will be made.

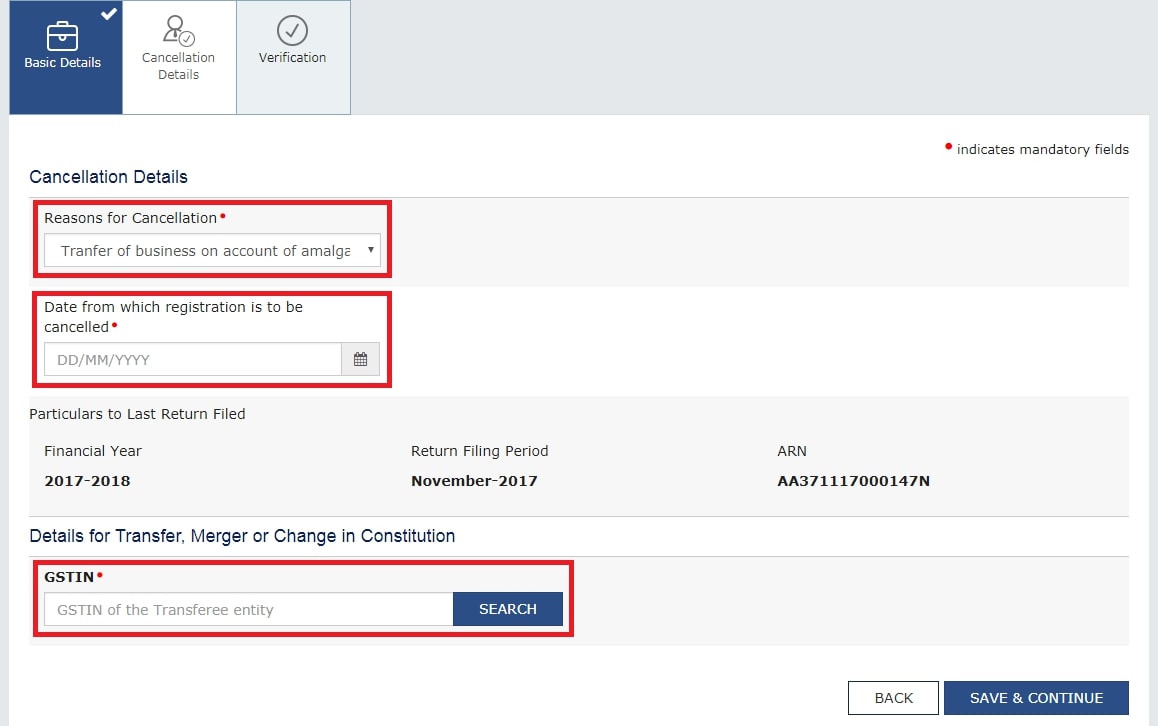

Transfer of business on account of amalgamation, merger, de-merger, sale, leased or otherwise:-

Enter the date from which registration is to be cancelled.

-

Provide the GSTIN of the transferee entity under the Details for Transfer, Merger or Change in Constitution section. System will validate the same, and based upon it’s Legal Name of Business, will auto-populate the Trade Name.

-

-

Click the SAVE & CONTINUE button.

Notes:-

This will mark the second tab also as complete.

-

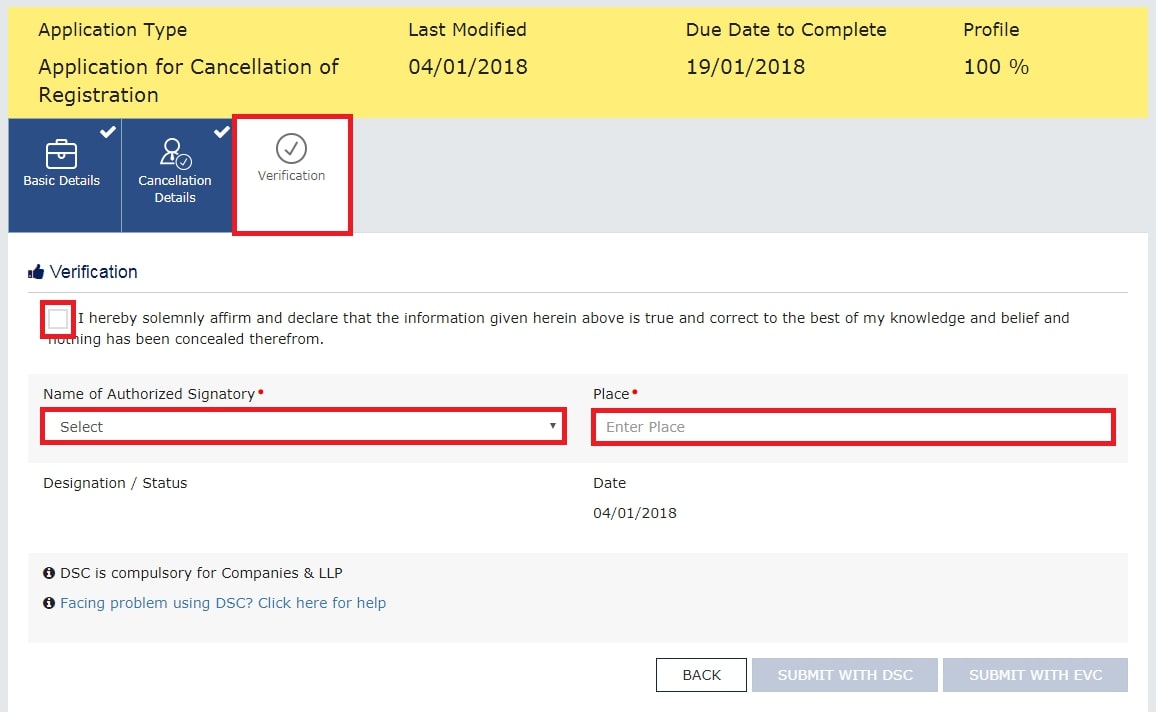

The next tab, Verification will get activated.

-

-

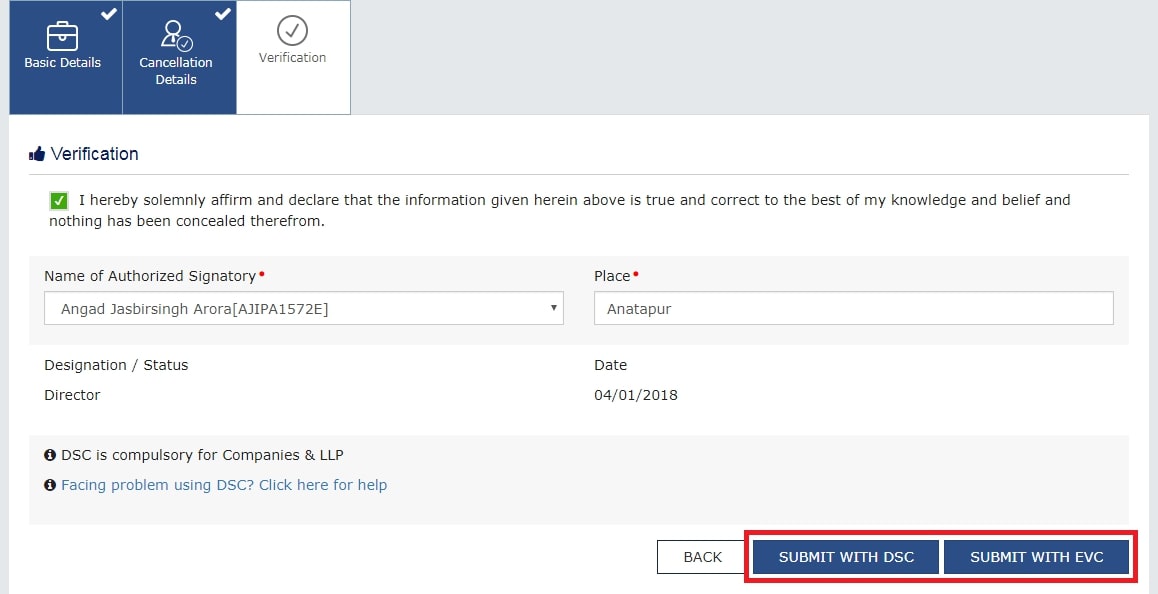

Check the Verification statement box to declare that the information given in this form is true and correct, and that nothing has been concealed there from.

-

Select the name of the authorized signatory from the Name of Authorized Signatory drop-down.

-

Enter the Place of making this declaration.

Note: Notice that the system auto-populates the authorised signatory’s designation or status. -

Sign the form by using either your Digital Signature Certificate (DSC), or the EVC option.

Notes:-

For the purpose of simplicity, this user manual has followed the EVC path.

-

If using a DSC, you will be required to select your registered DSC from the Em-Signer pop-up window and then proceed from there accordingly.

-

-

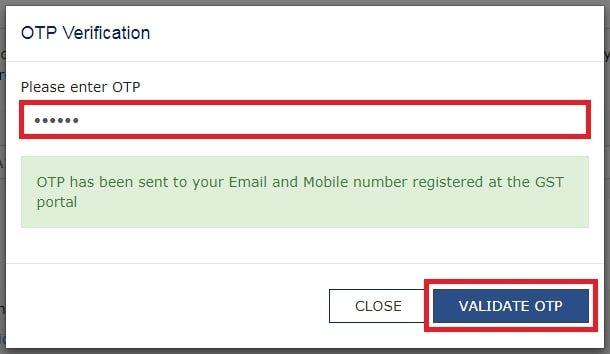

Enter the OTP.

Notes:-

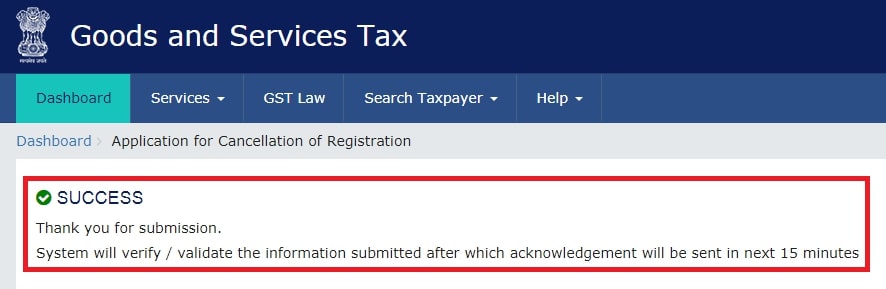

On successfully filing the application for cancellation of registration, the system will generate the ARN and display a confirmation message.

-

A confirmation message will also be sent by GST Portal on your registered mobile phone number and e-mail-ID.

-

After this stage, the concerned Tax Official will review your application and take a decision accordingly.

-

-

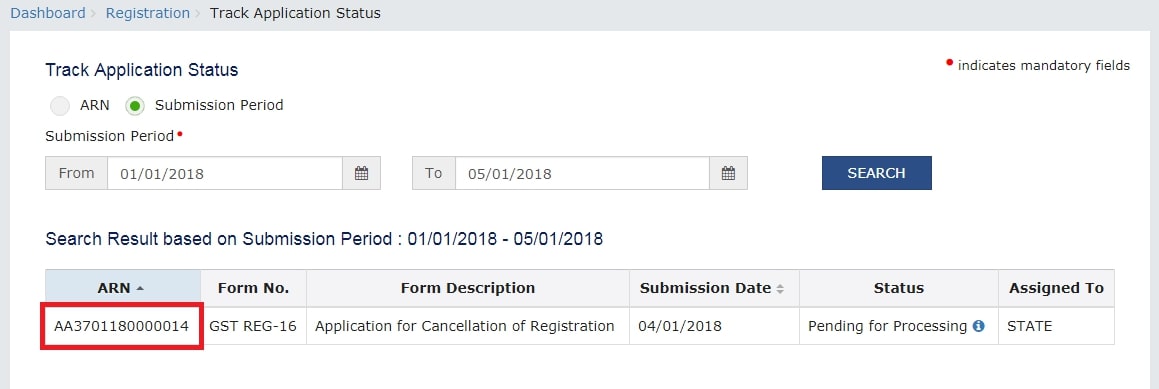

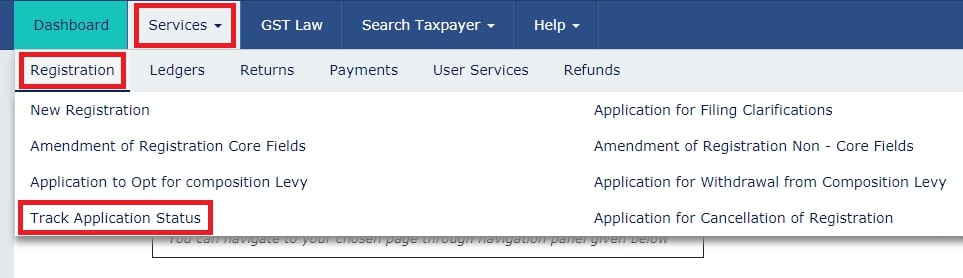

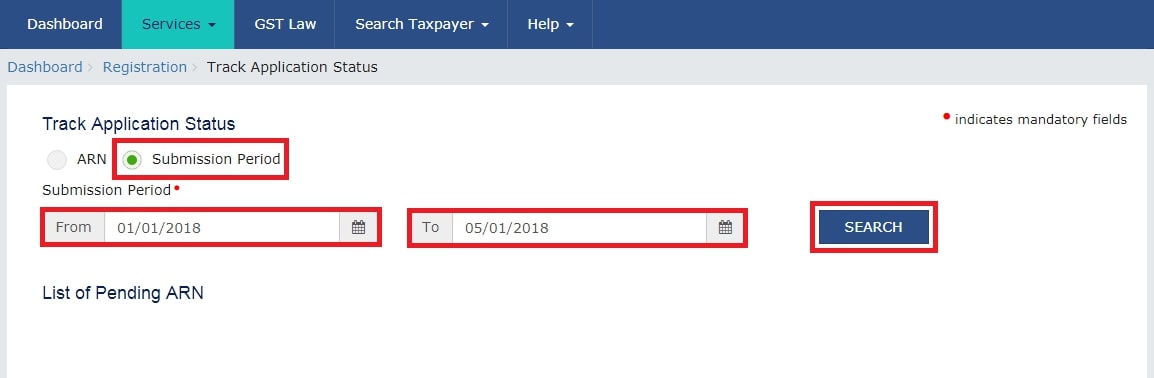

To view the ARN, navigate to the Services > Registration > Track Application Status option.

-

Select Submission Period radio button.

-

Enter the From and To dates between which you filed for cancellation of registration.

-

Click the SEARCH button.

Note: The search result will display the ARN corresponding to your filed application.